According to a US-based international development research lab, a large portion of Chinese development financing under the China-Pakistan Economic Corridor (CPEC) consists of loans issued at commercial rates instead of grants. The report shows that 95.2% of the development finance is based on loans. A majority of these loans are in the energy, infrastructure, and transport sector.

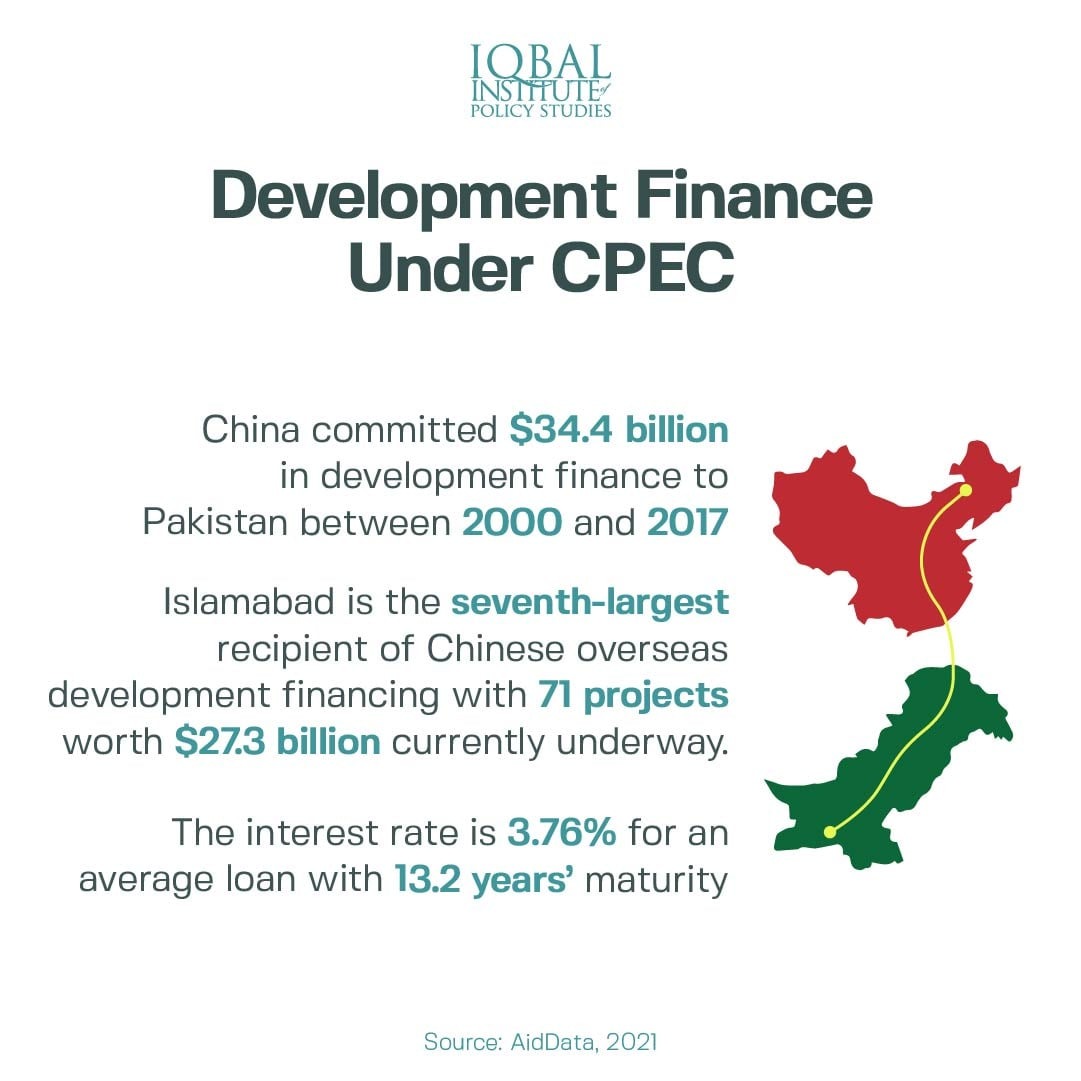

The report also highlighted several statistics related to the categories of development finance under CPEC. The report revealed that between 2007 and 2017, USD 34.4 billion have been committed by China to CPEC. In addition, Islamabad is the seventh-largest recipient of Chinese overseas development financing. Furthermore, the report shows that an individual average loan bears an interest rate of 3.76% with 13.2 years maturity period.

According to Special Assistant of Prime Minister on CPEC Affairs Khalid Mansoor, all projects under CPEC are fully transparent and have zero hidden loans. All the financial details of the projects are public information and can be accessed by the concerned authorities.

Leave a Reply