The Federal Board of Revenue has achieved a greater milestone this week as the organization met a greater than expected revenue collection target. The improved revenue performance comes at a time when the pandemic shook the foundations of the economy.

The FBR is putting in efforts to broaden the tax base of the country. The incumbent government aims to hold tax evaders accountable and prevent the depletion of the country’s resources. The existing performance of the organization shows that the efforts are proving fruitful.

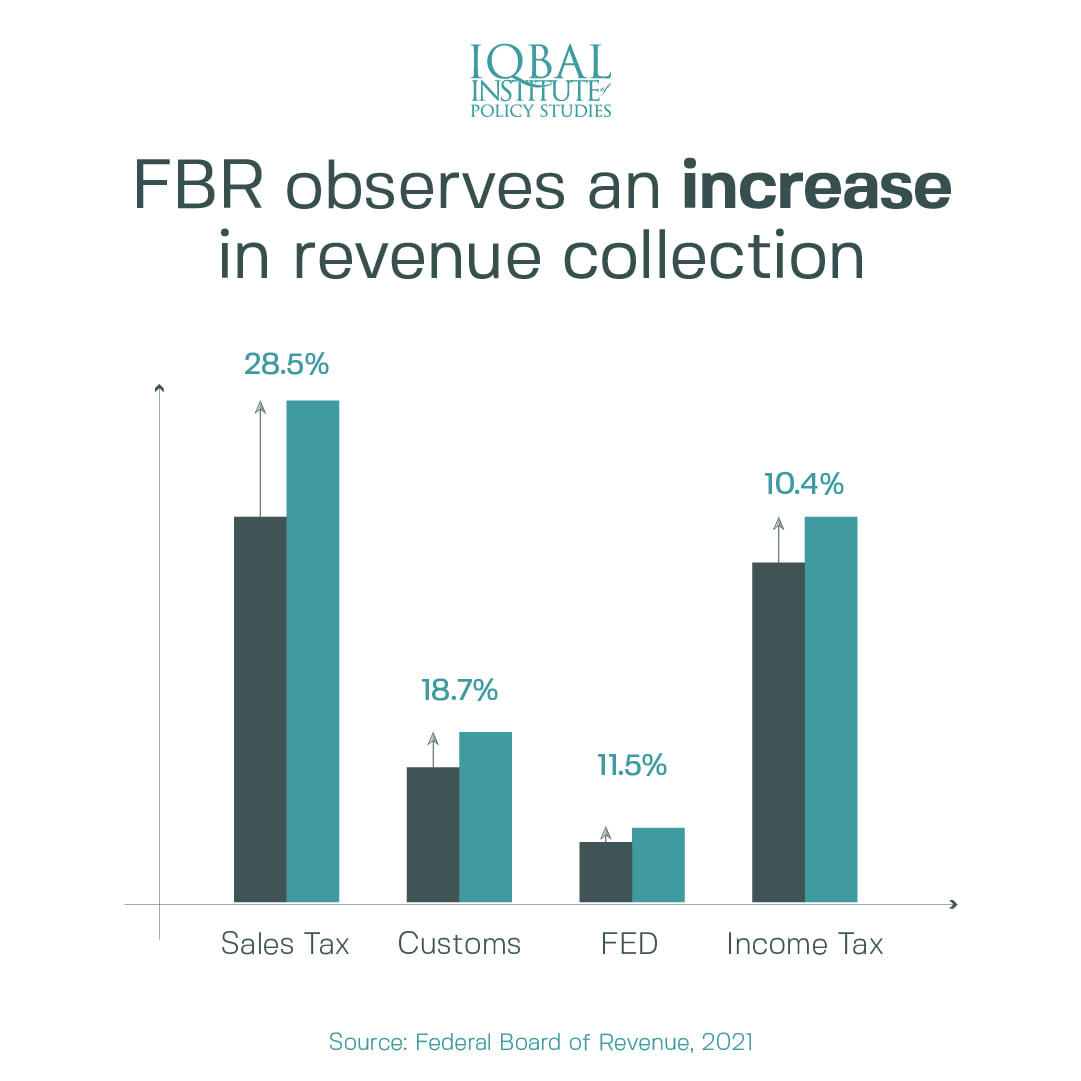

Revenue collection is distributed across different areas, like excise duty, income tax, customs, and sales tax. In all these areas, sales tax has observed the highest percentage increase of 28.2% as compared to May last year, followed by customs, FED, and income tax.

The FBR aims to increase tax file returns to broaden the income tax base. According to the FBR, almost 1.4 million taxpayers have mis-declared their assets to escape the tax bracket. This wide gap between the required and existing tax base impedes the revenue targets of the organization and can prove to be a drain on the national economy.

Leave a Reply