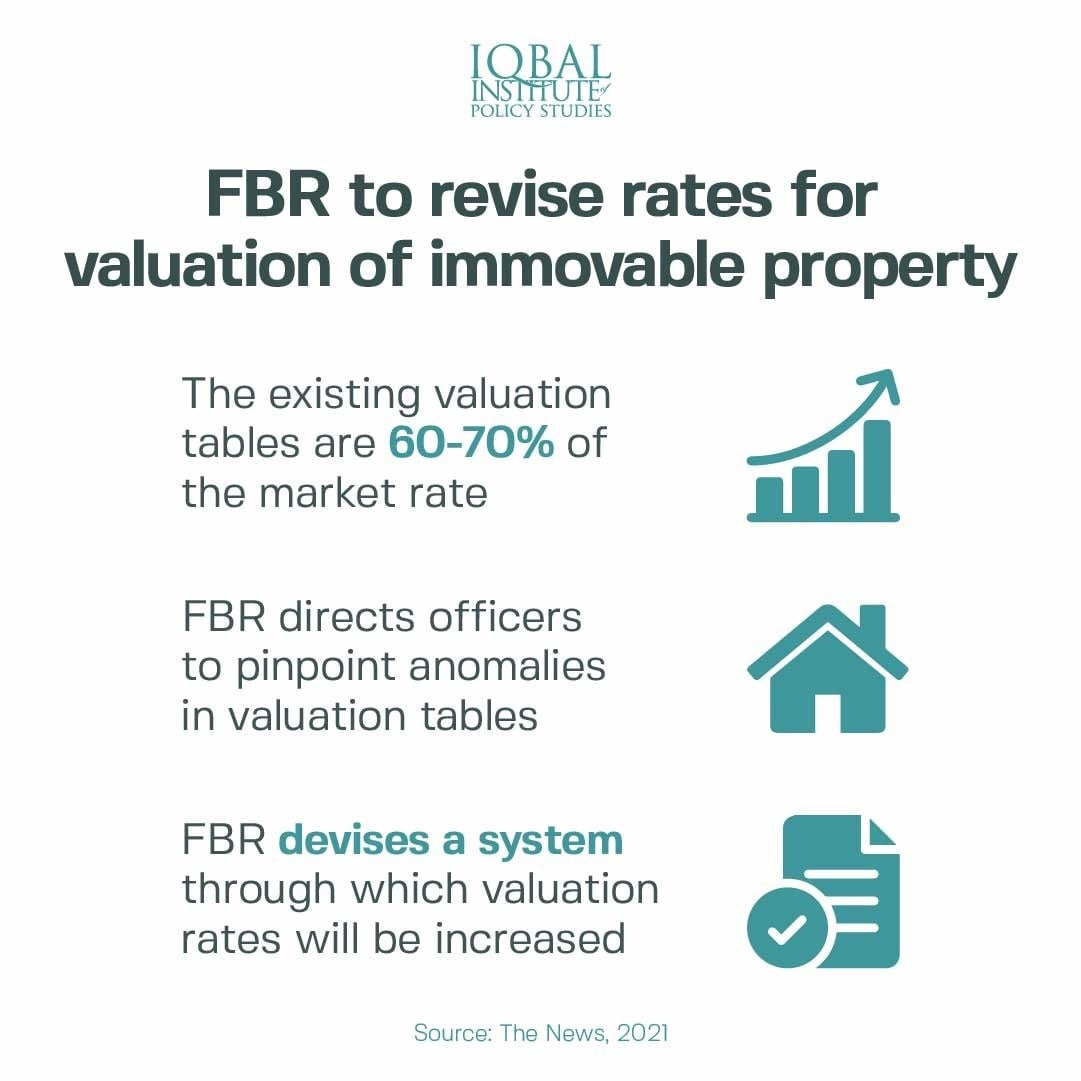

To bring the valuation tables of immovable property at par with the market rates, the FBR has decided to revise the rates for the valuation of immovable property in major urban centres and adjoining areas closer to the market prices. Under the Income Tax Ordinance 2001, the FBR has directed its officers across the country to create revised valuation tables of immovable property. Currently, the existing valuation tables are 60-70% of the market rates, implying that the revised rates require an upward revision. Traditionally, there exist three different rates for immovable property valuation in Pakistan, which include the District Commissioner rate, the FBR rate, and the market rate.

Under the new directions from the FBR, the updated valuation tables will be issued with approval from the senior leadership of the Inland Revenues Department. Moreover, a Statutory Regulatory Order (SRO) will be shared with the board for the given purpose. Furthermore, the FBR has directed its officers to point out any gaps in the valuation rates and tables, otherwise, the Regional Tax Offices (RTOs) will be held responsible for it.

According to Real Estate Consultant Association’s General Secretary Ahsan Malik, the FBR will include real estate representatives while revising the valuation tables in the respective cities. The input of those real estate advisers and agents is crucial for gauging the proper value of the immovable property. The inclusion of real estate agents and advisors in the process will make the valuation more holistic.

Leave a Reply