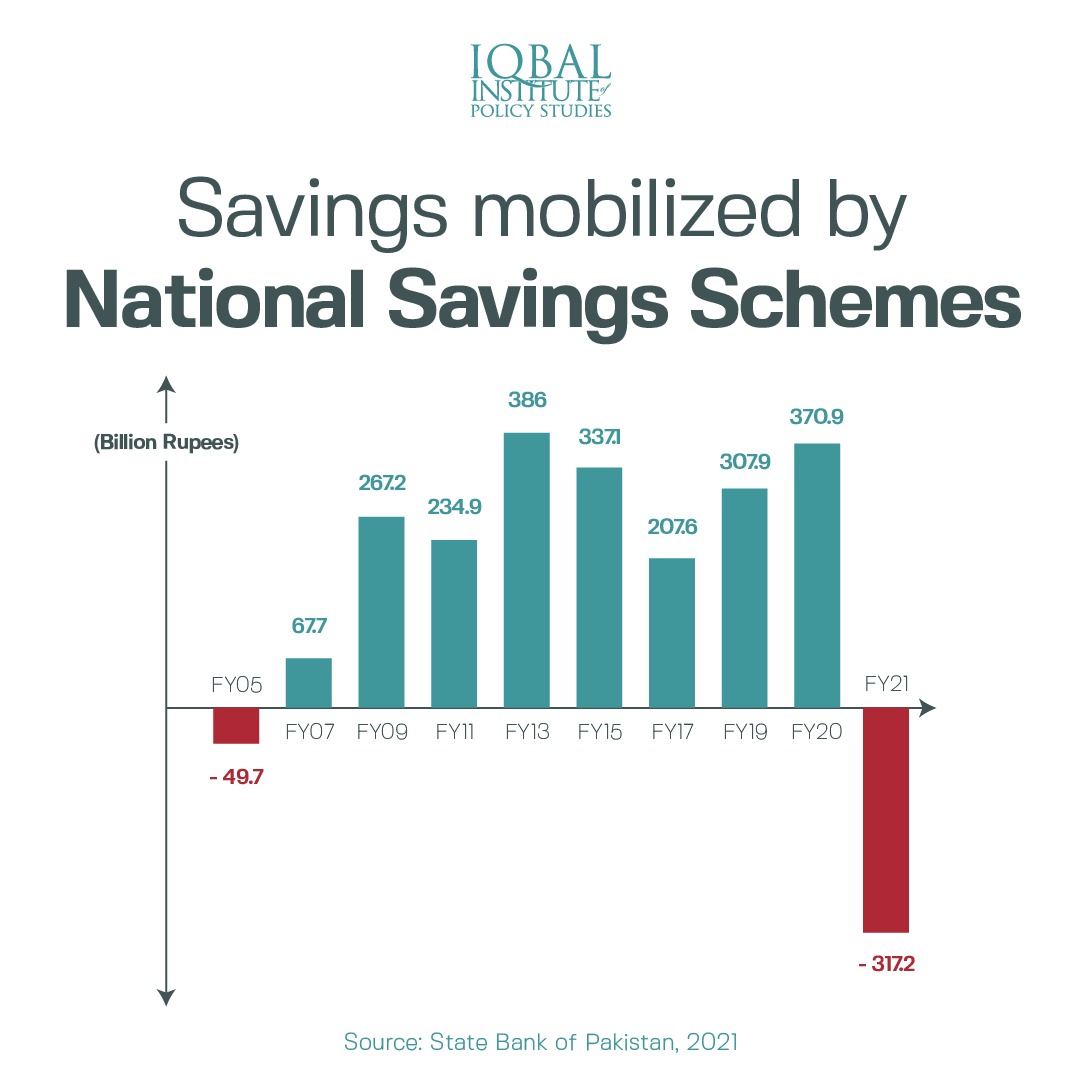

According to data released by the State Bank of Pakistan (SBP) on Monday, investors pulled out Rs 317.2 billion from the National Savings Scheme (NSS) in the year 2020-21. Since 2004-05, the NSS has shows negative net savings for the first time.

According to analysts, there are several reasons for the massive outflow of savings from the NSS. Firstly, a ban on financial institutions to invest in the NSS limited the revenue streams for the NSS. This severely affected its net receipt of savings every month. Secondly, the circulation of prize bonds of higher denominations played a role in shifting the focus away from the NSS towards alternative ways of investing money. Lastly, the strict implementation of money laundering laws and policies has forced people to invest their money in other avenues.

The NSS is governed by the Central Directorate of National Savings (CDNS) which is a federal government-run organization. The NSS is trusted by the public as it yields better returns on public savings by eliminating intermediaries in the process. The investments received by the NSS are pegged to the cut-off yields on government securities which allows the public to receive a higher yield on their investment.

Leave a Reply