Microfinance services by the government allow low-income households to stabilise their income flows and save for future needs. Microfinancing includes both business development services territory of non-financial and financial services which acts as an essential strategy in poverty reduction and development of rural areas. In Pakistan, microfinance is gaining importance as an effective tool for social mobilisation and poverty alleviation in the country.

Pakistan’s Microfinance Services

In Pakistan, the microfinance era began in 1970 with the formation of the Agriculture Development Bank of Pakistan which started to provide subsidised loans to the rural population. Pakistan’s microfinance services gained importance when it was added as an important pillar of poverty alleviation strategy and followed the revolution in the past decade by gradually mainstreaming into the formal banking system. In late 2017, Pakistan’s microfinance sector had more than 40 accredited institutions operating in 106 districts. Microfinance services of a country help families and small businesses to prosper, and at times of crisis, it can help them cope and rebuild.

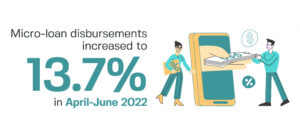

Increase in Pakistan’s Micro-Loan Disbursements

Recently, there has been an increase of 13.7% in the disbursement of microfinance loans in April-June 2022. The total increase is Rs153.1 billion, from Rs134.7bn in 2021 (Pakistan Microfinance Network, 2022).

Considering the increase in micro-loans, the government has decided to allow microfinance banks to disburse small business loans of up to Rs3m which will likely to increase the quarterly disbursements and the overall average loan size. Besides this, microfinance banks will now actively finance tractors and other commercial vehicles and extend long-term loans for affordable housing.

Considering the increase in micro-loans, the government has decided to allow microfinance banks to disburse small business loans of up to Rs3m which will likely to increase the quarterly disbursements and the overall average loan size. Besides this, microfinance banks will now actively finance tractors and other commercial vehicles and extend long-term loans for affordable housing.

Way Forward

Despite the current increase in microfinancing, six in every 10 potential customers in the country still can’t access microfinance services. In Pakistan, the government needs to finance agriculture livelihoods and small businesses to maintain their operations, invest in technologies, and grow businesses. Promoting microfinance services in the country will help the government to improve its ranking in the Sustainable Development Goals (SDGs) of ‘No poverty. Leveraging microfinance services to promote small businesses in rural areas can generate job opportunities and raise the income of poor communities.

Leave a Reply