The government aims to introduce a subsidy programme to reduce the prices of edible oil in the country. Rising inflation, due to an unstable rupee against the USD, has forced the government to cut the general sales tax by half and eliminate the 2% additional customs duty on edible oil. It will reduce the price of edible oil by Rs 45-50 per kg.

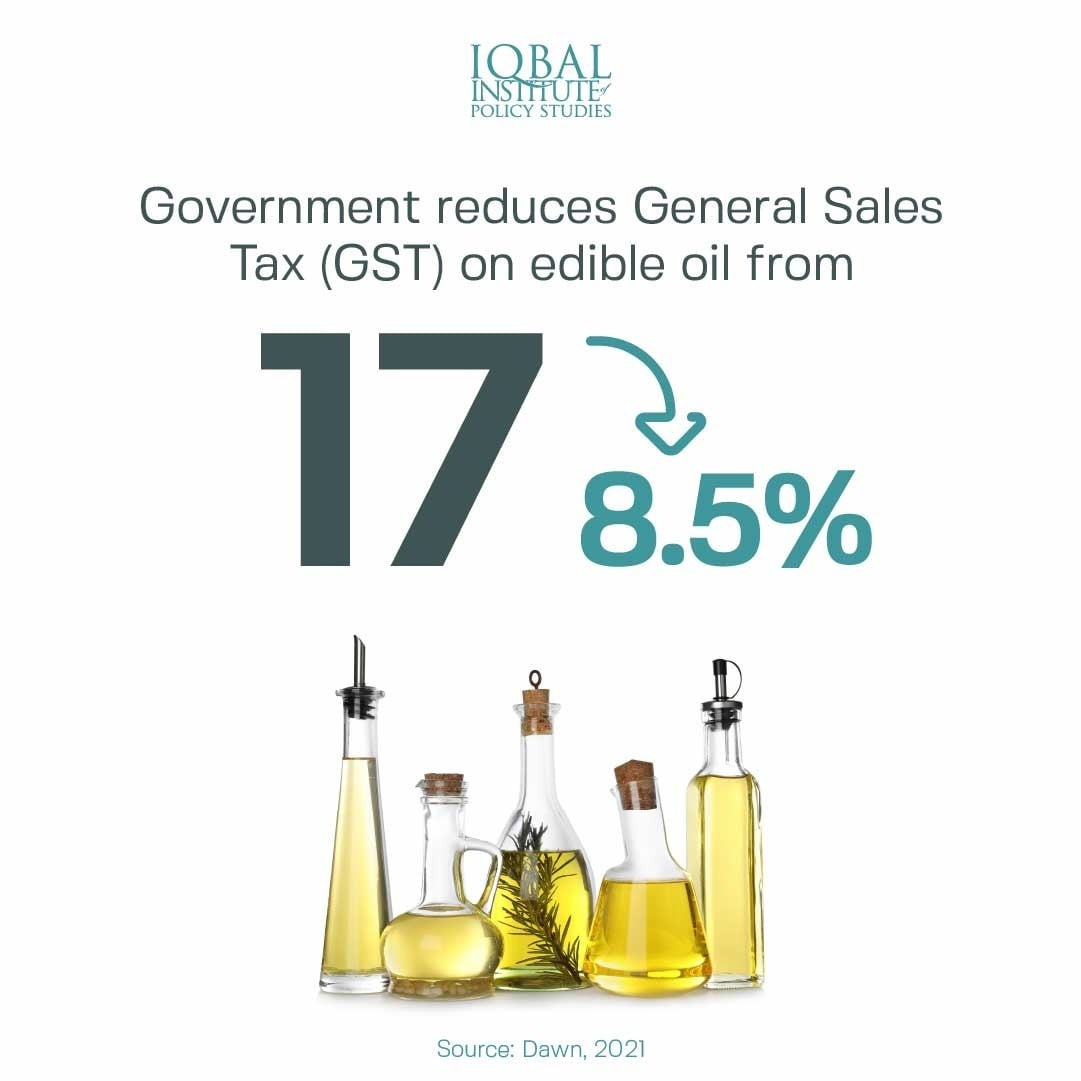

According to the Minister for Planning and Development, Asad Umar, the GST on edible oils will be reduced from 17 to 8.5% due to the recent spike in inflation. Economists and market experts have contradictory views on the stability of market prices, and it has forced the federal government to provide subsidies and concessions in the food sector.

According to Asad Umar, the Prime Minister will introduce a major targeted subsidy scheme for the masses in the coming days which will provide some relief to the lower-income demographic. Besides Asad Umar, Finance Minister Shaukat tarin also proposed reducing taxation on edible oils.

Leave a Reply