Overview

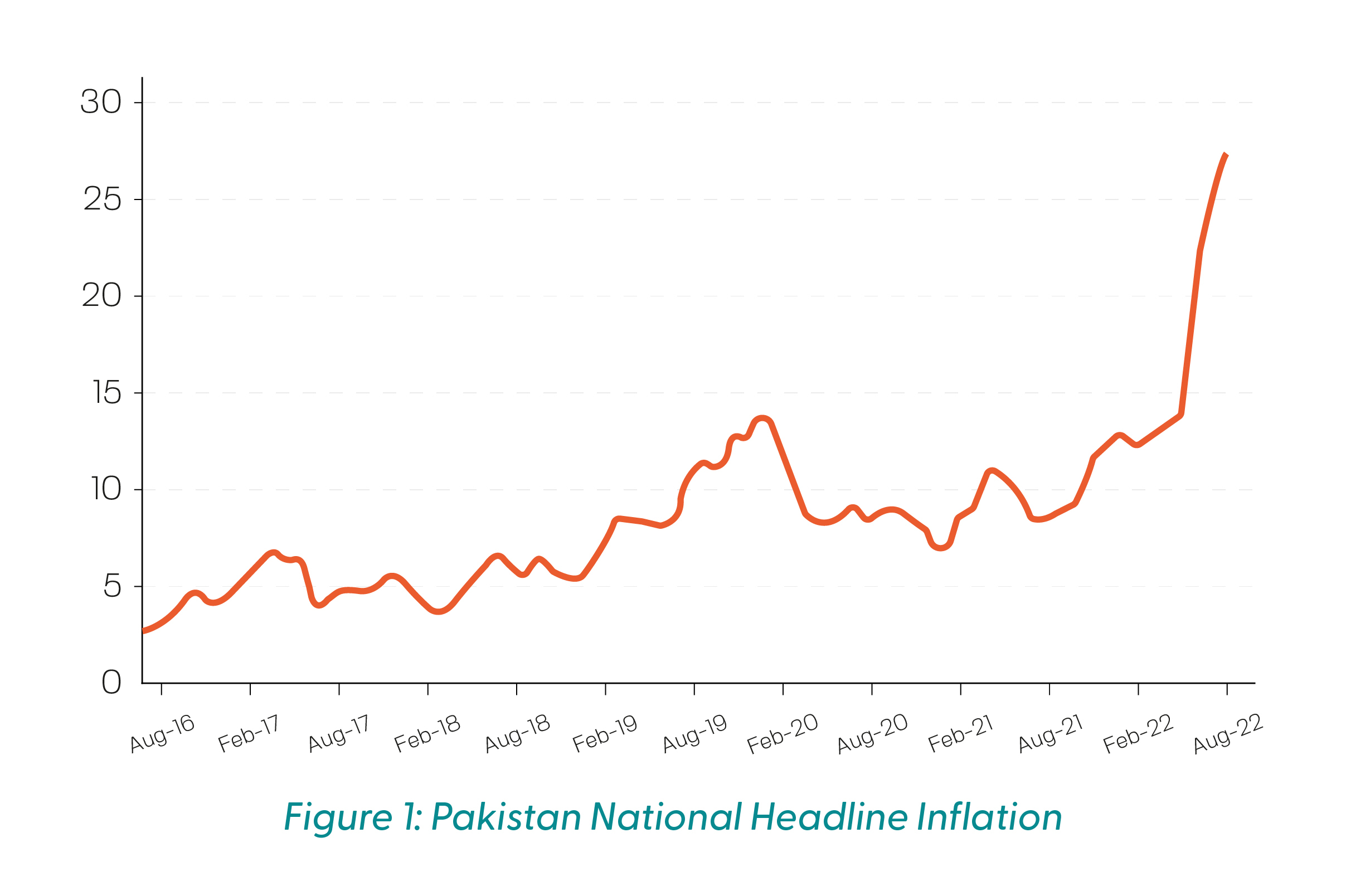

For the past many decades, Pakistan’s economy has seen a perpetual increase in inflation. It is driven due to external and domestic factors. External factors include increases in the global price of food, energy and fuel. Whereas domestic factors that contribute to the rise in inflation are overheating of the economy and phasing out of the energy price relief measures. Recent flooding has elevated inflation due to supply chain disruptions in many essential commodities and the destruction of crops and livestock. It is also expected that the shortage of these items will lead to further inflation in the coming months.

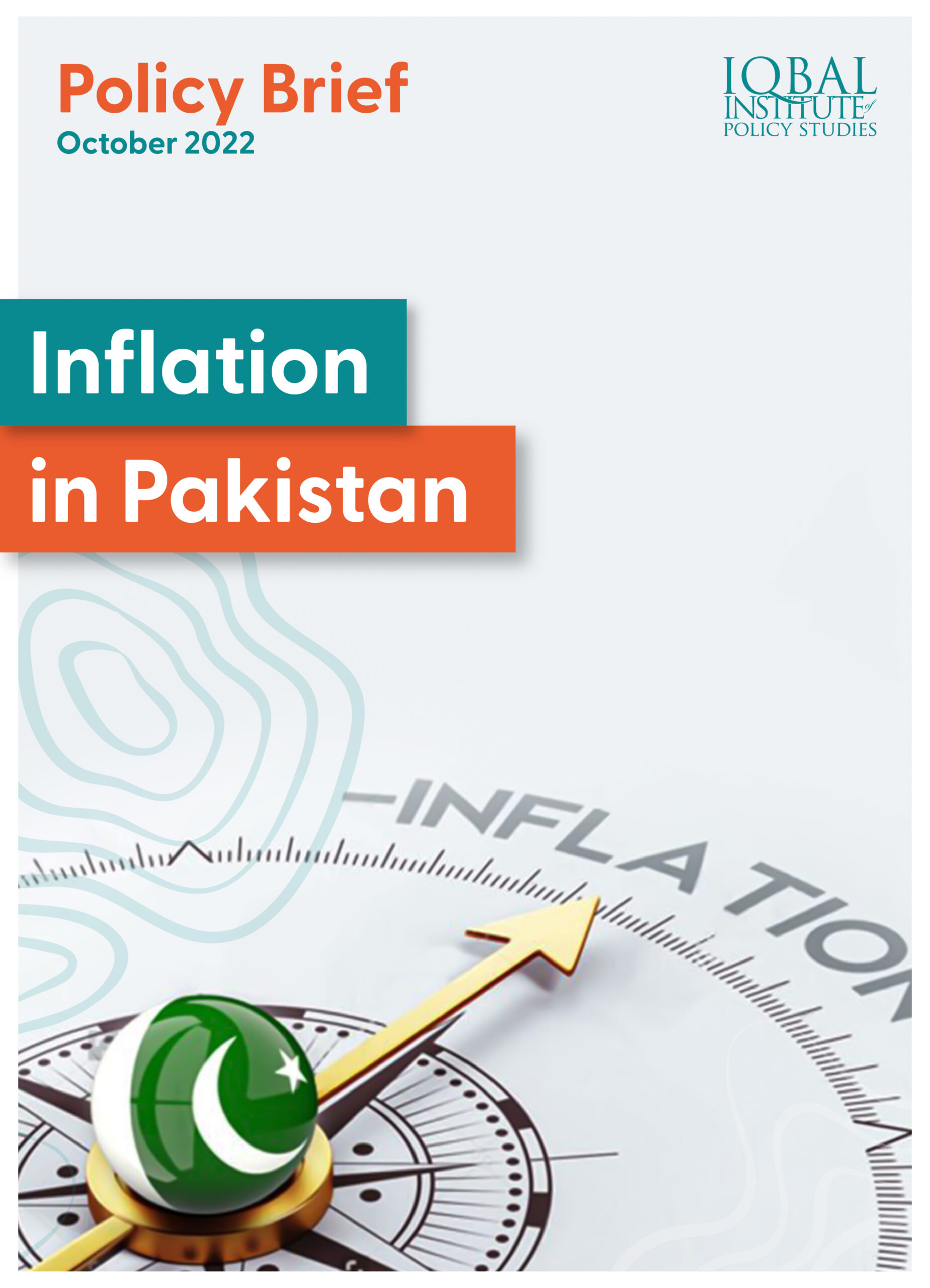

According to the World Bank, poor households are facing a disproportionate burden of inflation. Due to the differences in their patterns of consumption, the lower-income strata will face food inflation and the upper-income strata will face energy price inflation. As a result of this, poor households will suffer more from inflation. Additionally, poor households will have to utilise their savings to combat the impact of high inflation and end up consuming low-quality products.

Comparison of Inflation

Drivers of Inflation

Higher Food and Energy Prices

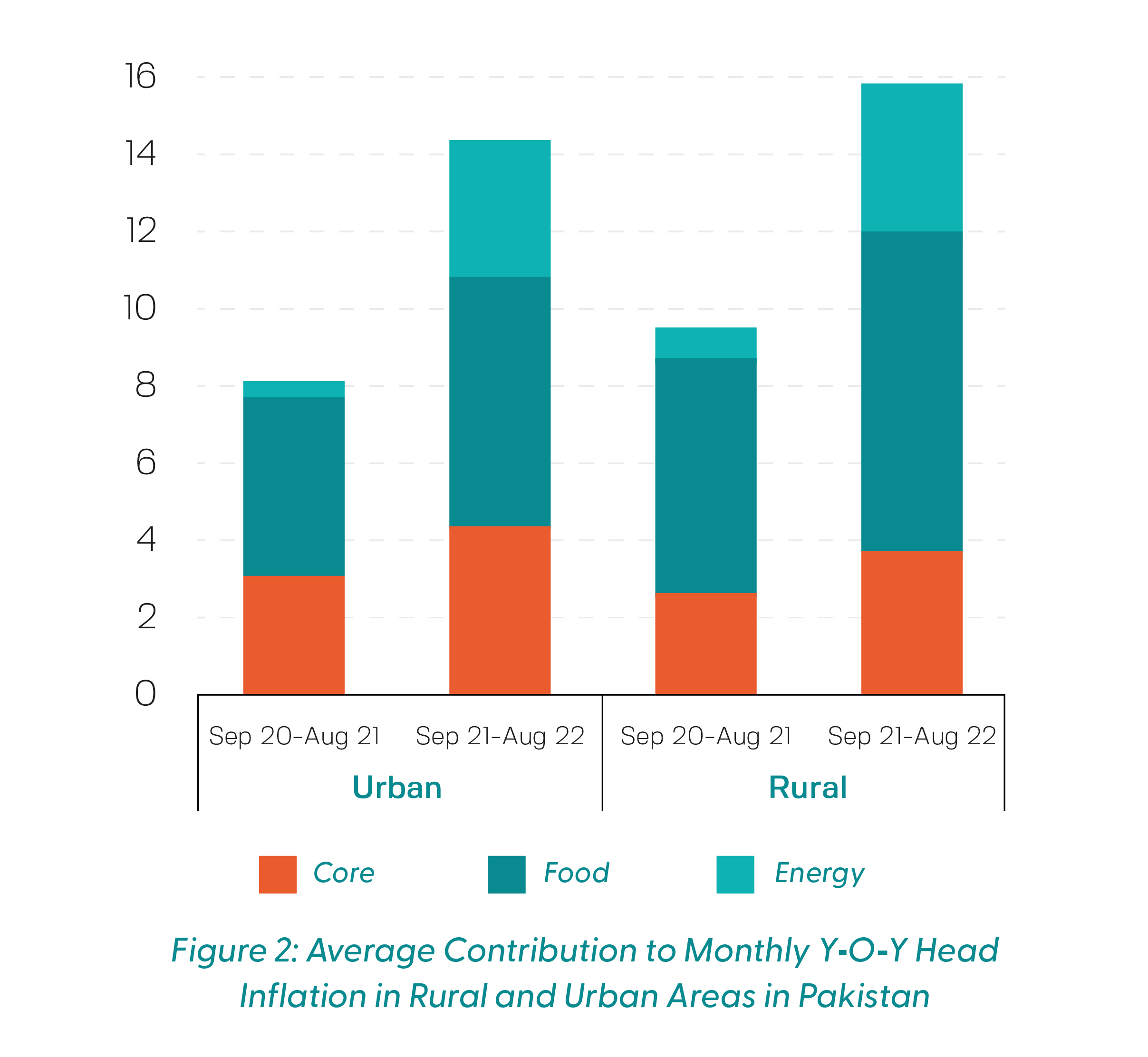

A food and energy crisis is mainly responsible for rapidly increasing inflation in Pakistan. This year, inflation escalated by 30.3% on a YoY basis in rural areas and 28.8% on YoY bases in urban areas. However, an increase in energy prices is also a factor in increasing inflation as the government must intervene to adjust fuel prices. Due to an increase in fuel prices and tariff adjustment policies, energy price inflation increased to 80.6% in urban areas and 67.8% in rural areas.

External Factors

The pandemic has disrupted the supply of commodities around the world. Additionally, the Ukraine-Russia war has added volatility and uncertainty in global supply chains because these countries are the major suppliers of agricultural products, energy, and fertilisers. Moreover, countries are facing climate change issues affecting their agricultural production, leading to an increase in food prices. The government has decided to restrict the export of essential agricultural products such as wheat and rice to fulfil domestic demand. This initiative has led to a further hike in inflation.

Economic Situation

An expansionary fiscal policy and a delayed response to monetary policy in Pakistan is overheating the economy, which is further increasing inflation. Moreover, the rupee devaluation is worsening the situation.

Recent Floods

Devastating floods have exacerbated the inflationary pressure. It has destroyed 400 acres of agricultural land, which will negatively affect the cotton, date, rice, and wheat crop. More than a million livestock animals have been washed away. Moreover, much of the cereals, seed, and animal feedstock have been destroyed, thereby wiping out the inputs needed for future crop and livestock production. A decrease in agricultural production, disruption to food processing, and disruption to slaughtering will elate inflation.

Short-Term Recommendations

- Encourage domestic production of goods.

- Encourage start-ups and develop strategic plans for every sector.

- Targeted Poverty Alleviation and Social Safety programs such as Ehsaas Programme and BISP should expand the coverage.

- Policy planning from academia must be reviewed, keeping in consideration the empirical evidence of inflation.

- To give subsidies and loans to industries, the government must partner with banks to give loans at reasonable interest rates, as reducing taxes will generate less revenue for the government.

- Exporting labour services should be encouraged because it will increase the inflow of remittances.

- Rather than giving a minimum wage to labour, the government should opt for a living wage that counts the inflation factor in it as well.

- Energy subsidies must be avoided as it benefits the better off, but poor people are affected badly.

- Maintaining the independence of the State Bank of Pakistan (SBP), combined with proactive and data-driven monetary policymaking to support price stability objectives.

- Government should promote climate-smart agriculture.

- For economic growth, women must also be empowered and engaged in the latest activities such as marketing, packaging, business strategies etc., as they make up 48.5% of the population.

Long-Term Recommendations

- Authorities must consider the statistical findings that negate the policy of increasing Policy rates to decrease inflation. They must take an unconventional approach and bring down the policy rate to experience an overall reduction in inflation.

- Economic diversification is required to achieve economic growth.

- An accurate survey of energy reserves must be conducted to forecast the capacity of reserves and import energy resources accordingly or move to renewable resources.

- Government should promote alternative sources of energy production such as solar power and wind energy to solve the energy crisis.

- Policies to increase the inflow of remittances and investments must be implemented to reduce high prices.

- Domestic borrowing must be capped at a specific percentage, as an increase in domestic credit also results in an increase in inflation.

- Industries must be established to produce raw materials and goods domestically. It will bring an inflow of money, reduce the cost of production and promote exports while decreasing imports.

- Government must incentivise the private sector to have a more resilient supply chain.

- After the impacts of flooding on agriculture, the structure of the economy will reduce output. Cash crops must be identified for quick returns as the fiscal space is limited.

Leave a Reply