Introduction

Real estate is among the highest profitable industries globally, offering numerous investment opportunities. Whether renting or buying a house or investing in REITs, it gives investors a decent return on investment. There are various ways to invest in real estate, including residential and commercial real estate, construction companies, real estate companies etc. Nowadays; passive real estate investing is creating a buzz and becoming a popular investment choice. This type of investment generates passive income and appreciation from the property with tax benefits, risk diversification, increased buying power, and many more.

This blog will discuss some of the major benefits of passive real estate investing.

What is Passive Real Estate Investing?

Passive real estate investing is a way to invest in real estate properties to generate passive income and long-term appreciation while minimising the required active involvement. It involves investing in real estate assets without having to manage or participate in day-to-day operations actively.

There are various ways to engage in passive real estate investing, including:

Real Estate Investment Trusts (REITs)

REITs own, manage, or finance income-generating real estate. Investing in REITs empowers investors to get exposure to a diversified portfolio of properties without directly owning or operating them. REITs are publicly traded entities and can be bought and sold on stock exchanges.

Real Estate Crowdfunding

This method involves pooling funds with different investors to invest in real estate projects. Online platforms facilitate this process, allowing individuals to invest in specific properties or portfolios. The crowdfunding platform handles property selection, management, and administration, making it a relatively passive investment option.

Rental Properties

Investors can purchase residential or commercial assets and hire a property management company to handle tenant selection, rent collection, maintenance, and other operational tasks. This method allows investors to earn rental income while delegating day-to-day responsibilities to professionals.

Real Estate Syndication

Syndication involves pooling capital from multiple investors to purchase large-scale commercial properties or development projects collectively. A syndicator or sponsor manages the investment, handles operations, and distributes profits to investors based on their contribution.

Major Benefits of Passive Real Estate Investing

Passive real estate investing offers several benefits for investors looking to generate passive income and build wealth. Here are some key advantages of passive real estate investing:

Regular Cash Flow

Passive real estate investing has the potential for regular cash flow. Investors can receive monthly or quarterly rental income by investing in income-generating properties such as rental units or commercial buildings, providing a steady cash flow stream.

Diversification

Real estate investing allows for the diversification of investment portfolios. Investing in different types of properties across various locations can spread their risk and reduce their exposure to market volatility. This diversification can help protect against potential losses and provide more stable returns.

Appreciation

Real estate has the capability to appreciate in the long run, regardless of the fluctuation in property values in the short term. Investors can benefit from potential appreciation and build wealth over time by investing passively in real estate.

Leverage

Real estate investing often allows for leverage, meaning investors can use borrowed money to purchase properties, resulting in magnified potential returns on investment. Investors can control larger assets and potentially generate higher profits using other people’s money.

Tax Advantages

Real estate investing offers several tax benefits to help investors save money. These may include deductions for mortgage interest, property taxes, depreciation, and maintenance expenses. Additionally, passive real estate investing can qualify for the favourable tax treatment the real estate professional designation provides.

Limited Time and Effort

Passive real estate investing requires minimal time and effort from investors. Unlike active real estate investing, where investors are directly involved in property management, passive investors can delegate tasks to property managers or real estate investment firms. This method allows investors to enjoy the benefits of real estate without the day-to-day responsibilities.

Inflation Hedge

Real estate is often considered a good hedge against inflation. As the cost of living increases, rental incomes and property values also tend to rise. Real estate investments can help preserve and even grow wealth during inflationary periods.

Portfolio Stability

Including real estate in an investment portfolio can enhance stability as it has a low connection with other asset classes like stocks and bonds, so its performance often moves independently. This low correlation can help smooth out portfolio returns and reduce overall volatility.

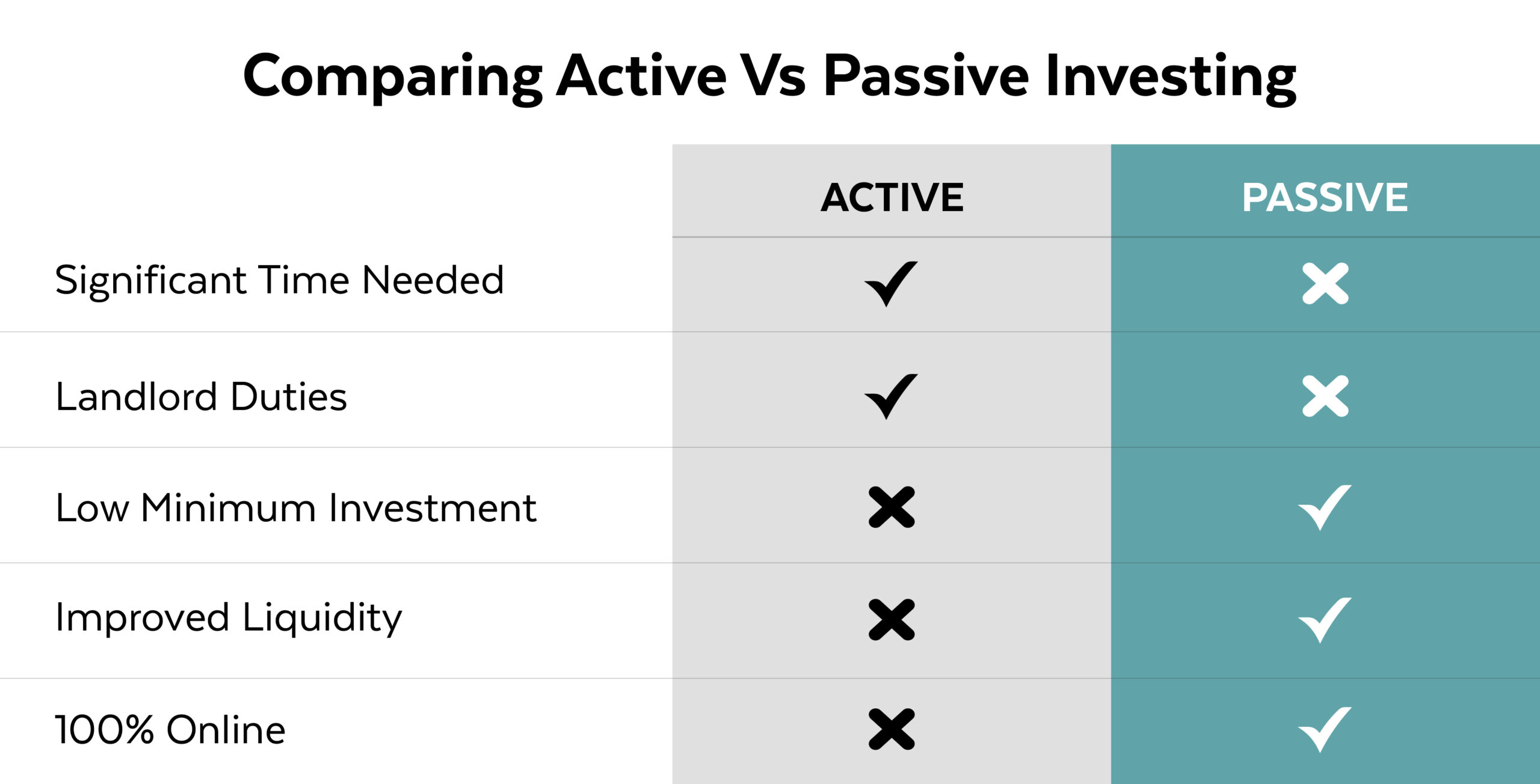

Active vs Passive Real Estate Investing

Active and passive real estate investing has some prominent differences:

Active Real Estate Investing

Directly operating real estate needs significant upfront involvement and investment, with revenue streams from stable tenants becoming increasingly passive over time.

Completing a purchase may result in a shift in lifestyle.

Active real estate investing requires a full-time job. Some active investors “flip” real estate or purchase, repair and resell it. Passive investing in real estate provides a fully passive kind of income, allowing investors to hold any profession.

Passive Real Estate Investing

This investment method requires basically just investment capital.

Passive investors in real estate never take on any landlord responsibilities. Instead, passive investors rely on professional property managers to supervise tenants and maintain rental properties.

Generally, Passive investing is more liquid. In passive real estate, investors can trade in and out of real estate positions with a few limitations, while active investors may be obligated to sell a property outright to liquidate.

Conclusion

Conclusion

In conclusion, passive income investing can be an excellent way to achieve financial freedom and peace of mind. Considering the benefits of passive real estate investing, like low minimum investment, high liquidity, and free of landlord duties, it is also a reliable investment, even in volatile markets, over long periods of time. Regardless of the advantages, every investment has some risks. Therefore, every investor needs to research developing an investment strategy, as it’s important to pursue an investing approach that’s just right for their needs.

This article is written by Radma Nouman. Radma is a Research Analyst at the Iqbal Institute of Policy Studies (IIPS).

Leave a Reply