Overview of the Textile Sector in Pakistan

The textile and clothing sector is considered the backbone of the economy. Trade in Textiles represents 4.62% of the total world trade. However, textile and apparel exports are increasing the diversification of products and market competitiveness, strengthening domestic and international markets (Sattar & Majeed, 2022).

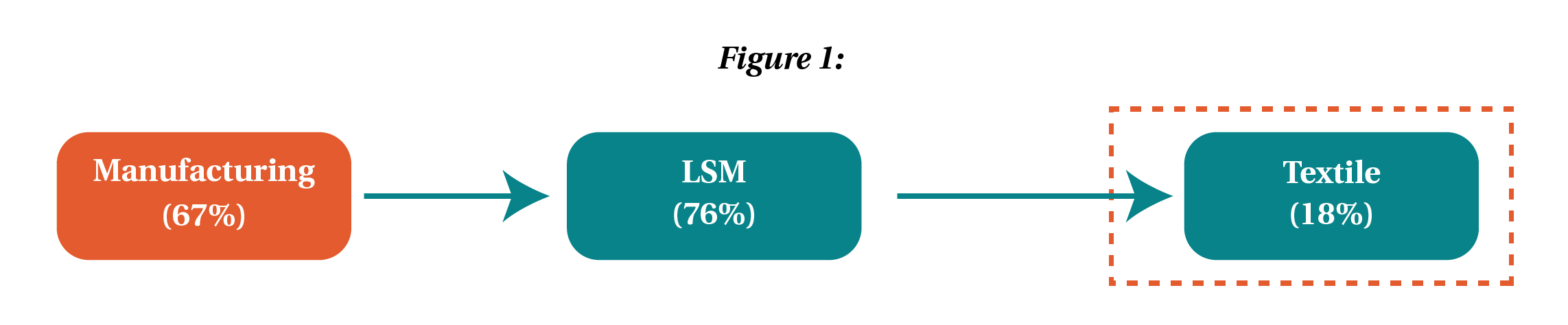

In Asia, Pakistan is ranked as the 8th largest exporter of textile products. In 2020, Pakistan’s textiles were the world’s 7th most-traded products in total trade. It is considered the single largest manufacturing sector (as shown in the figure)

Textile alone employs 38% of the manufacturing labour force. As per the estimates, more than 5 billion USD of textile and garment machinery has been imported into Pakistan in the last couple of years. The private sector’s efforts and inputs mainly run this sector.

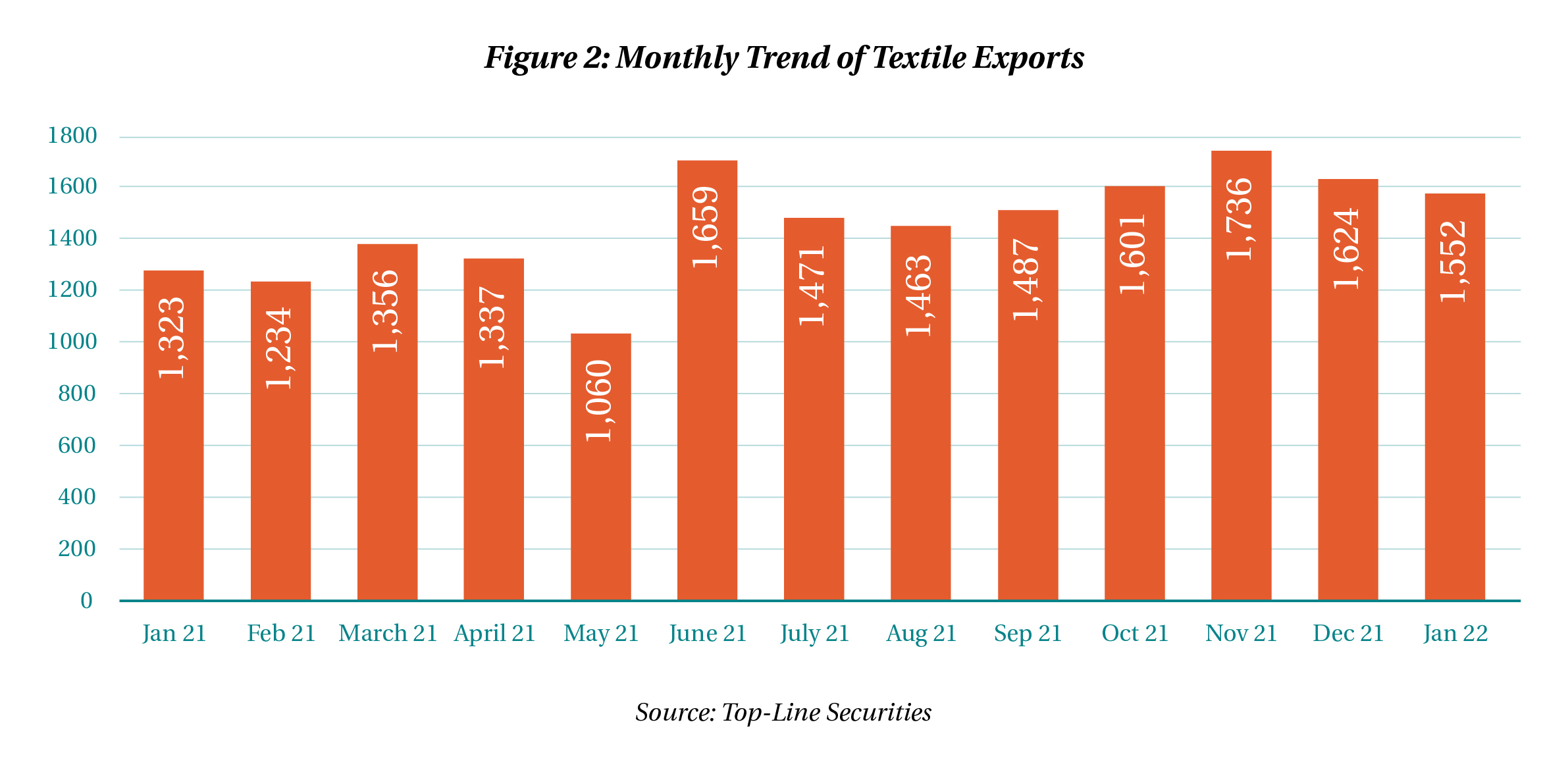

In the fiscal year 2021, Pakistan exported textile products worth $19.33 billion, which showed an increase in export, i.e., 25.53 per cent compared with $ 15.4 billion in the preceding year, as per the Pakistan Bureau of Statistics. The increase in export is due to government measures to support exporters in the wake of COVID-19.

The merchandise export growth fell in July 2022 after 22 months of the COVID-19 shock. The exports decreased to $2.21 billion in the first month of the current fiscal year from $2.34 billion in the corresponding month last year.

World Bank’s Pakistan Development Update recommends that the government focus on private investment and export to reduce the trade imbalance and increase export competitiveness. It will support the economy to resist shocks and risks.

The World Bank report has highlighted the key challenges responsible for hindering export: less availability of finance for a longer period to increase export capacity, high import tariffs, inappropriate and less efficient market intelligence service for exporters and low productivity of firms (World Bank, 2021). The incessant decline in export has severe implications for Foreign exchange reserves, economic productivity and job market growth.

Hence, to nurture the textile sector Government of Pakistan need to steadily move towards more systematic, innovative, inclusive and sustainable growth as the rest of the world is doing.

Reasons for the Decline of the Textile Sector

Energy Crises

Pakistan is facing severe energy crises, which badly affect the textile industry as about 150 units have been closed in the last six months. Due to this closure, 2.5 million workers were laid off, and it badly affected exports to other countries. The cost of production has increased up to 100%, along with an unprecedented increase in the electricity tariffs. It is due to the rise in fuel price from approximately Rs 150 in 2021 to Rs 250 in 2022. Thus, the electricity tariff was Rs 18 per unit in 2021 and increased to Rs 36 per unit at the end of 2022.

Rupee Devaluation

The excessive devaluation of the rupee increases the cost of doing business and increases inflation. Cotton yarn is available at international prices; therefore, devaluation increases cotton and yarn prices in rupees. In Bangladesh, the price of cotton yarn is low compared to Pakistan due to the low utilities cost. Not only these other inputs are also imported, such as chemicals, dyes, accessories, packing material etc. The devaluation of the currency will increase the cost of exportable goods. It is increasing the miseries of textile mill owners. Industrialists are left with two options: either close down or expand their manufactured goods’ prices and become non-competitive in the international market (Daily Times, 2019).

High Competition in International Market

One of the major reasons for the decline is the higher competition in the international market. Countries like Bangladesh, Vietnam, India and Thailand are emerging as new textile exporters and have a comparative advantage in this sector. The reasons Pakistan is losing its place in the international market are due to outdated machinery and equipment, lack of investment and the rising cost of cotton.

Environmental Factor

Last year, the devastating floods ruined the production of the cotton crop. It was found that 50% of the crop has been destroyed, and anticipated that overall cotton yield during 2022-23 will remain 40% low. The cotton yield is currently limited to 4.2 million bales compared to 7.3 million in the previous fiscal year. The government has imported 3.5 million bale to fulfil the country’s demand. Similarly, due to low cotton crop productivity government has to import 7.5 million bales from other countries to meet the demand (Nations, 2023).

Poor Seed Quality

The cotton producer farmers must utilise high-yielding hybrid seed varieties to produce crops. Because of this, cotton production is decreasing, and the government has to spend millions of dollars to bridge the gap in domestic demand.

Lack of Technology Adoption

The majority of the operation in the textile industry are conducted manually due to the need for more technology adoption. The global procurement process procedures have incorporated emerging technologies in the value chain process. However, due to a lack of digitisation, the whole value chain process of the textile industry is being impacted adversely and confronted with many inefficiencies in the system.

Recommendation

There is a dire need to establish a linkage between research institutions and the textile industry to create new products and value-added services.

The government must incorporate technology, which will be the only way to increase productivity and revolutionise the textile manufacturing landscape.

The government needs to collaborate with the private sector to facilitate innovation.

Government should provide tax relaxation to the textile owner in the wake of an increase in input cost.

To improve the quality of the cotton, the government should use machine base cotton picking facilities.

The stakeholders should shift their focus toward revamping the production of value-added products such as bedwear, towels, knitwear, ready-made garments etc.

Increase labour productivity by providing high-end training in collaboration with Technical Vocational Education Training (TVET).

Need for financial and technological investment because the country imports machinery from outside and has low engineering skills.

To protect the textile industry government should make arrangements to provide electricity without interruption.

Tax refund from the government needs to be processed efficiently.

There is a need to establish market intelligence and refine the marketing and publicity framework to build a good image of Pakistani textile products in the international markets.

References

Daily Times. (2019). Rupee devaluation is detrimental for value-added textile sector. Retrieved from Daily Times: https://dailytimes.com.pk/396049/rupee-devaluation-detrimental-for-value-added-textile-sector/

Nations. (2023, January 09). Pakistan’s textile sector hit hard by the energy crisis, causing the rupee fall. Retrieved from Nations.com.pk: https://www.nation.com.pk/09-Jan-2023/pakistan-s-textile-sector-hit-hard-by-energy-crisis-rupee-fall

PITB. (2018). Textile Sector of Pakistan. Retrieved from http://pbit.gop.pk/: http://pbit.gop.pk/system/files/Textile%20Industry.pdf

Sattar, S., & Majeed, U. (2022). Falling textile exports in Pakistan. Retrieved from Global Village Space: https://www.globalvillagespace.com/falling-textile-exports-in-pakistan/

World Bank. (2021). Strengthening Exports is Critical for Pakistan’s Sustained Economic Growth. Retrieved from World Bank Blog: https://www.worldbank.org/en/news/press-release/2021/10/28/strengthening-exports-is-critical-for-pakistan-s-sustained-economic-growth

Leave a Reply