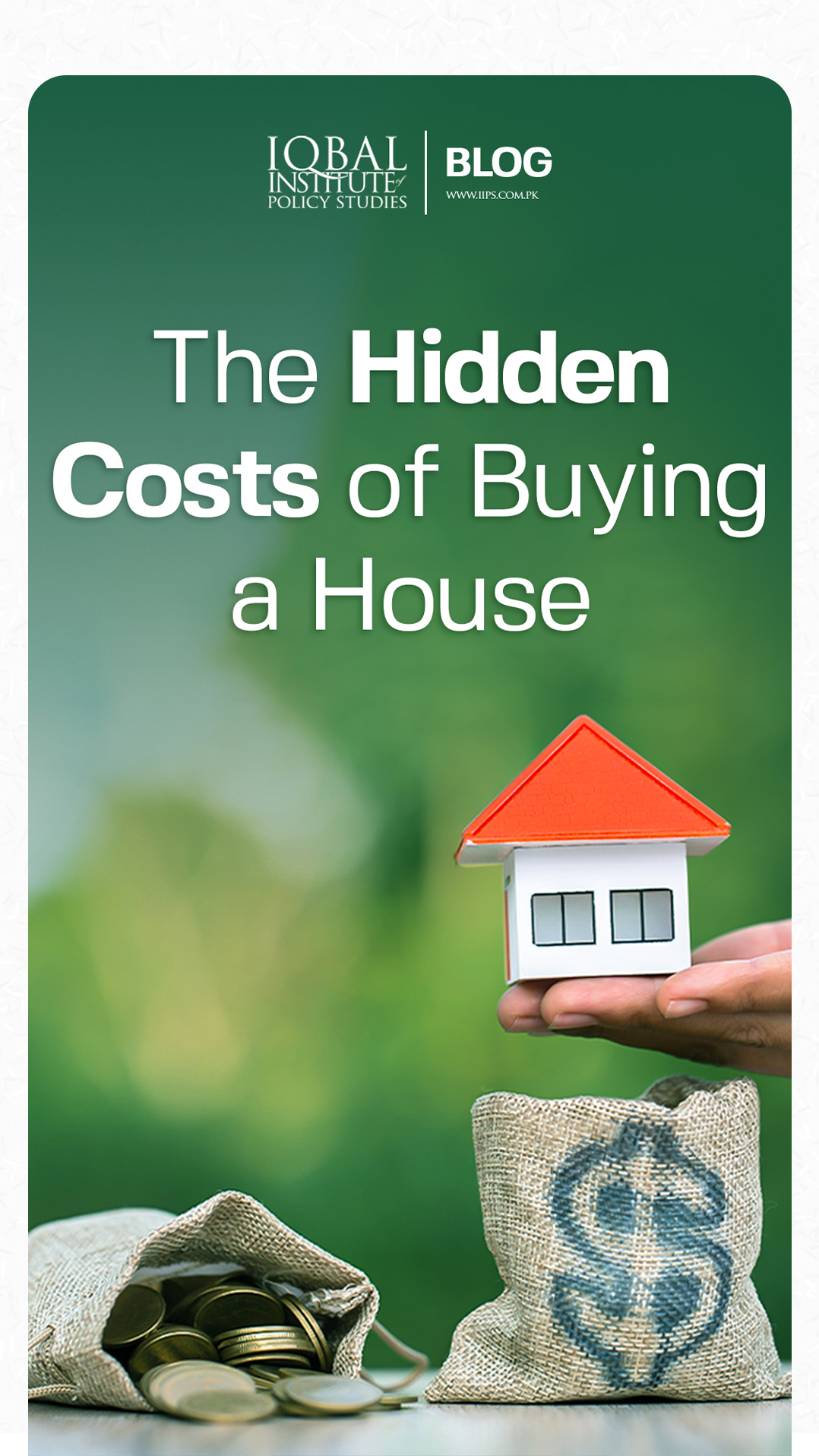

Introduction

Buying a house is one of the most important financial decisions people make during their lifetime. Most people dream of building or buying their own house. However, there are numerous costs associated with the process. Several hidden costs can accumulate and impact the affordability of a residential property. Most first-time homebuyers are sensitive to these hidden expenses. Therefore, they need to be careful before deciding on buying a house. With the rapidly increasing prices of property, land, and construction material, potential homeowners must evaluate a house for hidden costs.

Below are some of the costs most people neglect before buying or building a house.

Understanding Property Taxation

Every homeowner is legally bound to pay property taxes imposed every quarter. Paying property taxes is important as, for the most part, the government utilises the revenue from these taxes in providing maintenance services such as security and fire protection, garbage collection, and maintenance of public roads, spaces, and parks. The government sets the tax targets for homeowners. This tax is non-negotiable. Therefore, homebuyers need to prepare to meet these mandatory costs attached to buying a house.

Closing Costs

Most first-time home buyers only anticipate the down payments while buying a house. A down payment is an initial up-front payment for the house by a buyer. Closing costs are all the fees that need to be paid before closing the deal. Several fees cover the entire cost of closing a home-buying deal, such as title insurance, appraisal femes broker fees, and interests. The closing cost of a regular house can be between 3% to 6% of the purchase price.

Another important part of closing costs is good faith money which is a deposit made by the buyer to prove the intent and ability to purchase a house. The good faith money costs about 1-3% of the home value and can vary depending upon the credit risk of the house as determined by banks.

Insurance Costs

In most developed countries, home insurance is necessary to protect homebuyers against floods, earthquakes, and natural disasters. Thus, homebuyers must sign home insurance contracts before taking possession of the house. In the case of a disaster caused by a previous lax owner, the onus of paying for the damage will not be placed on the new homebuyer. It is also crucial to ensure the house’s content, such as electronic appliances, doors, windows, and even carpets beside the house or apartment.

Home Maintenance and Renovations

Some of the highest costs in the home buying process are the unexpected costs after buying a house. According to homebuying experts, the older the home, the higher the chances of future home repair. Most older houses have structural issues that cannot be found easily on broad inspection. Decades-old water heaters and roofs act as a liability for most homebuyers. These hidden costs can sometimes build up to the extent that the property becomes a liability for homebuyers.

Home or building inspection becomes necessary under circumstances when the property under consideration is decades old. A qualified building inspector needs to be consulted and hired to inspect the building or house for signs of major and minor defects and identify any safety hazards, structural problems such as hidden moistures, termite sites, and pests. These inspection services charge a considerable fee and decrease the overall affordability.

Moving Fees

If you have to shift all your house belongings from one city to another, you will need to hire or rent trucks to move your stuff. The cost increases considerably if you are shifting from one city to another. Most first-time homebuyers forget to budget these things and reduce the affordability of a house.

Rethinking Home-Buying

As mentioned earlier, buying a house is one of the most important financial decisions an individual makes during their lifetime. If a potential homebuyer is not ready to deal with these attached hidden costs, they need to reconsider their decision or seek more affordable options to cut costs. As land and property prices increase, renting a house can be better than buying. All of the costs mentioned above are associated with home buying and not renting. Therefore, homebuyers need to rethink their investment decisions carefully before taking an irreversible step.

Conclusion

Paying multiple property taxes is unavoidable for homeowners. First-time homebuyers need to be careful and budget these taxes before buying a house. Most first-time homebuyers consider the down payments as the single most important costs during the home buying prices. However, closing costs are equally important and costly. Home renovation is a constant source of hidden expenses, especially when buying an old house that needs in-depth property inspection. Moreover, mandatory home insurance adds to the overall cost of buying a house. Thus, first-time homebuyers must rethink their investment decisions before buying a house.

Leave a Reply